Using US treasury yields to forecast recessions

Posted on 1st of July, 2019

Moved on 16th of March, 2020, a week after markets started falling after Corona outbreak. Clearly my understanding of why yield curves moved where sup-par at the time of writing and I have taken some more time to understand this process.

16th of March, 2020

Ever since I got into value investing and realized most stocks seemed to have been overvalued (this was around mid-2017 already) I have been trying to figure out how to gauge a macro-economic trend that might indicate an upcoming recession.

I am now convinced that we will see a global economic downturn around the end of this year, or early 2020.

There are a few reasons why I believe this to be the case. I am not well-informed enough to put my finger on the pulse exactly but these are my thoughts on the matter.

Before moving on to the yield curve, there are some other reasons why I believe it will not last long before we see a downturn. One of the main reasons is that we see a capital saturation of pretty much any type of market. Be it housing, private equity, or public traded stocks, values have skyrocketed over the last decade with vast amounts of capital flowing in. And it makes sense to see this happening, because all in all things are going well. People feel free enough and comfortable enough to spend and allocate capital instead of keeping it in the bank for the low interest rates that are currently being provided. However, it seems we have somewhat reached an upper bound. Looking at the housing market here in my country – The Netherlands – people are buying like never before for prices that are well-above historical prices. The only way for the current valuations to keep going up, or keep constant at the least, is if this pace keeps up. There are very little options above it (e.g. even more spending) but there is a lot of space below (slow-down in buying, rise in selling). What I mean by that is that there is very little place for improvement but a lot of place for a slow-down. The same thing goes for the stock market. For most stocks to justify their current valuation they need to keep showing ridiculous growth, while there is a lot below that that will drive prices down. On top of this, markets seem to be saturated with capital. As the big funds move all the capital of their primary, bigger investors into the market, they realize the only way to continue their own growth in revenue is by going after the smaller fish. Over the last 2 years I have seen a rise in advertisements by funds and exchanges that are aimed at the “common” person, where they are lowering their onboarding fund to a mere €500 with the goal of getting new, smaller clients on which management fees can be earned. I believe this tends to only happen, and be justified, when they have depleted all of the big funds, meaning the big capital is already in the market. Again, there is very little room above this (more capital going into the market) but there is a lot of room below (capital being pulled out). Looking at startups and private equity investing as well, we see incredible valuations for companies that have not even come close to profitability. This is not uncommon in the startup world as you are banking on growth and market position first before monetization but it seems the valuations have risen without a clear indicator as to why. Seed rounds are now the size of what a series A was 10 years ago and multiple companies IPO (and do well) with no clear path to profitability. This is most likely a result of, again, the market being saturated and large amounts of capital getting in over the last few years.

On all these fronts, there is very little margin for error. Either the incredible influx of capital continues and it maintains valuation, or everything else that can and will happen below it sets in, and valuations will start to tumble.

I’ve also heard, but am in no way informed about this, that apparently a similar thing as the 2005-6 derivative mortgage packaging is happening again but this time with loans to companies. Shitty loans to companies that have a very low chance of paying it back are being clumped together into a “diversified” package, which can then be sold again as a derivative with a decent-to-high rating, even though it consists of what Ryan Gosling would call “dog shit”. If that were to be true, and these companies start to default as well (especially when people start to sit on their money more), that’s not going to be pretty.

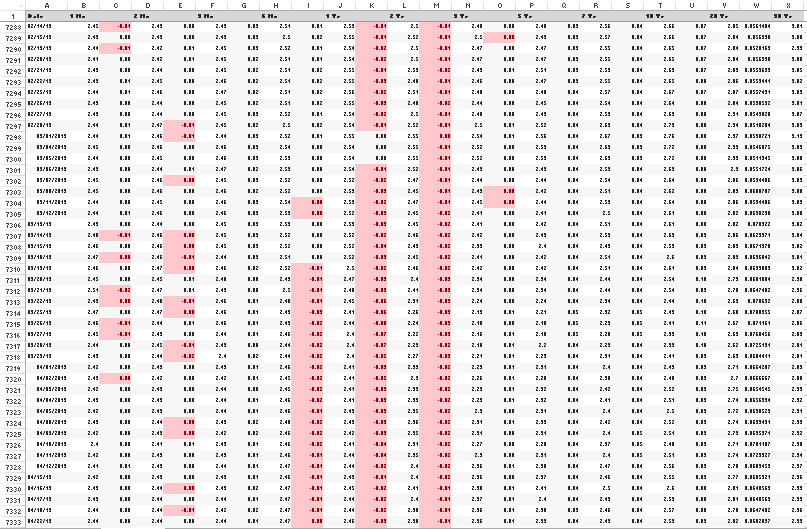

Yield curve on US treasury bonds

I find this a fascinating resource. Essentially it allows us to have an insight into what the FED thinks will happen with the interest rates in the future (the interest rates which they set, mind you). Normally, you’d want to see a continuous rise in yields on bonds as the term gets longer. Given that you need the hold the bond for a longer period before being able to convert it back, you need to be compensated for this. It makes sense to see a 2-year bond give a 2.5% interest and a 5-year bond a 2.8% interest, for example.

What does not make sense is to see an inversion here, for example a 2-year bond giving a 2.5% interest and a 5-year bond a 2.3% interest. The only reason this happens is because the FED thinks they need to drop interest rates around that time and they want to encourage spending around that time (e.g. there is hardly any reason for anybody to choose a 5-year bond with a lower interest rate over a 2-year bond with a higher rate, except if the interest rates in the last 3 of those 5 years are dropping below that 2.3%). Why would the FED drop interest rates in the future? To encourage spending. When do they need to encourage spending? When people are sitting on their money. When does that happen or what does then happen? A recession.

And this seems to be a consistent pattern. Before every major downturn we have seen in the last 3 decades we see this flipping of the interest rates, consistently. Before the dot-com bust, before the financial crisis of 2007, and now again in the last 4 months after over a decade of not a single interest rate being inversed. And, you see hardly any consistent signs of this when there is no following recession. I have not run any correlation tests on this but that might be an interesting project.

What also is not a great sign is that, in the past, adjusting interest rates to increase population spending was much more impactful. With 1-year bond interest rates around 6% before the dotcom bust, and around 5% before the financial crisis, the FED had a lot of room to adjust these downwards and increase spending. After the busts, you see interest rates having dropped to as low as 1% in 2008 and 0.3% in 2010-11. Right now, however, interest rates are already very low. The FED has kept interest rates incredibly low over the early 10’s and has only started to crank them up again as of 2015-2016. Currently, the 1-year interest rates are hovering around only 2.5%, and they are already being adjusted downwards again.

I fear that when things start to turn downward it is going to come down rather fast and hard with very little control that the FED can have on spending. I hope I am wrong. If shit hits the fan and people start to retract their capital, it is going to go fast and it seems there are very few brakes paddles.